Free Agent (aka Freelancer)

Every day you're hustling

There are a lot of benefits to doing contract work for multiple companies (making your own schedule, counting sweats as work attire). An easy breezy tax season is not one of them.

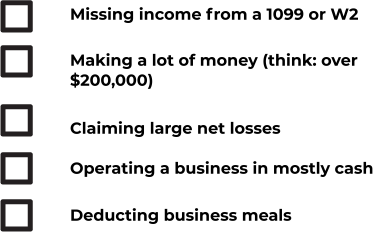

While full-timers file with a single W-2, freelancers need to collect a 1099 from each company that paid them $600 or more. Tip: if you don't get the form from a client by mid-February, send a reminder.

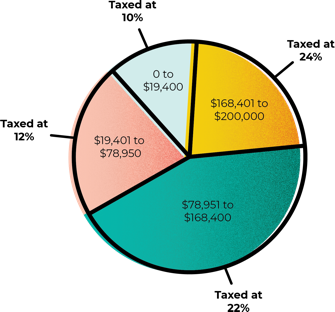

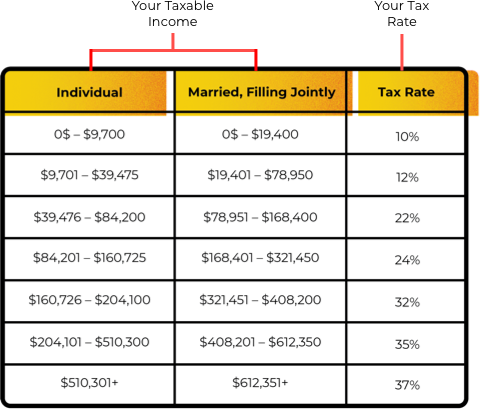

Also different: employers take Social Security and Medicare taxes out of every paycheck. But if you're self-employed, you cover that yourself by paying a 15.3% self-employment tax. So it helps to stay on top of taxes all year round and stash cash away as you earn it. You may want to make estimated tax payments quarterly (April 15, June 17, September 16, and January 15) or risk getting charged penalties for not paying enough or on time.

Bright side

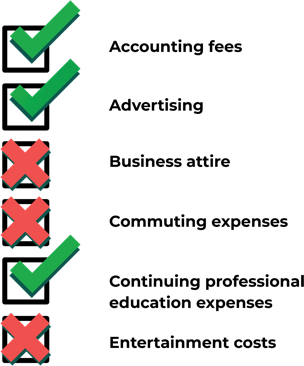

Deductions galore. As a freelancer, you can write off a whole bunch of things: business travel expenses, career-enhancing classes, your computer, even the portion of your housing costs that cover your home office (including part of your mortgage and utilities bills). That means you can reduce your taxable income by all those costs and shrink your tax bill. Cha-ching.

Prepare your self-employed tax status checklist

So, what's the Skimm?

Your tax return is as special as you are. Whether you're a 9-to-5-er, a side-hustler, flying solo, or raising a party of five, your personal situation dictates the size of your tax bill. The one thing all filers have in common: we can all benefit from some professional help. Freelancers should check out H&R Block's Self-Employed Online option. With new tools to maximize your business deductions, it's never been easier to file your taxes online.